The SMB -> Mid-Market -> Enterprise Model

A common playbook that many of today's leading vertical SaaS businesses followed was to start off by serving an SMB segment in whatever industry they were building software for, and then try to move upmarket over time, trying to land larger customers as their product becomes more robust. SMBs have relatively quick sales cycles, far less red tape and procurement process to wade through, and can be more forgiving of missing features - characteristics which make them a natural starting point for market entry. vSaaS businesses then typically try to grow within the SMB slice of their market, while simultaneously building out mid-market and enterprise offerings with the goal of landing higher contract values as their platform matures. Some vSaaS businesses have even chosen to operate in markets which are made up almost entirely of SMBs. One example of this approach would be Housecall Pro - this is software purpose built for small field services businesses which by their very nature do not have an ‘enterprise’ buyer type for a software vendor to target. We see this approach frequently in the current crop of early-stage companies focused on building software for 1-10 employee operations like nail salons, barber shops, pizza stores, etc.

While there have been successes in targeting the SMB segment, pursuing it can be risky and comes with a number of often overlooked downsides. The acquisition cost to onboard SMBs can be painfully high and the venture-fueled growth of the last generation of SMB-focused vSaaS is tough to replicate in today's funding environment. The huge Series B’s and Series C’s that enabled these SMB vSaaS sellers to grow rapidly (while venture dollars subsidized their staggering burn ratios) are increasingly hard to come by and show little sign of returning. SMB-focused vSaaS businesses tend to benefit initially from quick sales cycles, but then struggle with high churn and difficult retention metrics inherent to these buyers. You can see this in a number of SMB vSaaS vendors who have used venture dollars to rapidly scale to $5MM or $10MM in ARR, only to find their business stall out. Worse, many of the less ‘technical’ SMB opportunities have become quite crowded with four or five venture-backed players competing over a relatively small pie. The "business in a box" for a given SMB type is now a well understood model and the white space that existed 5-10 years ago is rapidly shrinking with modern cloud OS's popping up for every imaginable category.

The Rise of Enterprise Grade Vertical SaaS

At Bowery, we have increasingly been turning our attention to what we are calling enterprise grade vertical SaaS (or EGVS for short). These are industry-specific applications which can command low-to-mid five figure annual contract values in the earliest days of the business (e.g., at Seed stage) and prioritize selling only into large organizations with significant existing software budgets. EGVS companies typically have longer sales cycles (think months or quarters, not days or weeks) and will often employ a traditional direct sales motion rather than a light-touch PLG or self-serve approach. We believe EGVS businesses have a number of attractive characteristics from the perspective of an early-stage investor.

Chunkier Revenue - Given their target ACVs, far fewer customers need to be onboarded in order to hit the key revenue targets that investors look for at Series A ($1-$2MM) or Series B ($4MM-$8MM). EGVS companies focus on an even more concentrated buyer base than SMB vSaaS; this allows EGVS sellers to drive low customer acquisition costs by employing a tightly focused outbound sales motion. Instead of expensive ad campaigns that need to message to tens of thousands of fragmented buyers, EGVS businesses can instead position themselves at industry events and within trade publications as the new, must-have solution - providing them a more efficient path to get in front of key decision makers within their ICP. The high ACVs we see in EGVS allow for a more efficient scaling motion and greatly speed up the timeframe needed for these businesses to hit cash flow break-even. Due to their differing customer acquisition cost structure, SMB vSaaS sellers will typically remain unprofitable longer than an EGVS business will.

Stickier Customers - Enterprise grade vSaaS solutions inherently have longer sales cycles as your buyer is usually going through a corporate procurement process, rather than punching in their credit card. While sales cycles are longer for these platforms, they often involve multi-year rather than month-to-month contracts which can help cut down on churn and the ACVs commonly land in the tens of thousands. Another benefit of EGVS is that the buyers you are selling into are large, enduring businesses - unlike in SMB land, you don’t need to worry about their continued existence when renewal comes around, thereby improving retention.

Existing Willingness-to-Pay - The buyers of EGVS are typically large organizations which already have meaningful software spend baked into their budget. Unlike in the SMB vSaaS example, you are not trying to convince them to switch off pen-and-paper in favor of a cloud-based application. Instead, you are simply convincing them to swap out existing, on-prem legacy tech (which they are ideally unhappy with) for a more modern, accessible solution without them needing to fundamentally alter their day-to-day operations or justify large new spend buckets.

Less Competition - EGVS can thrive in industries where there is a high degree of complexity and where founders need to really know the space. These opportunities often require a little bit more insider knowledge to get off the ground, which leads them to be less crowded. In SMB/retail-oriented verticals, a venture-backed vSaaS business can find itself being the 8th or 10th solution to market and the playbook is already well worn (i.e., the business-in-a-box model we often see targeting SMB vertical opportunities where you build out a cloud platform with modules for managing customer communications, taking bookings/reservations, accepting payments, coordinating workforce and admin tasks, etc.).

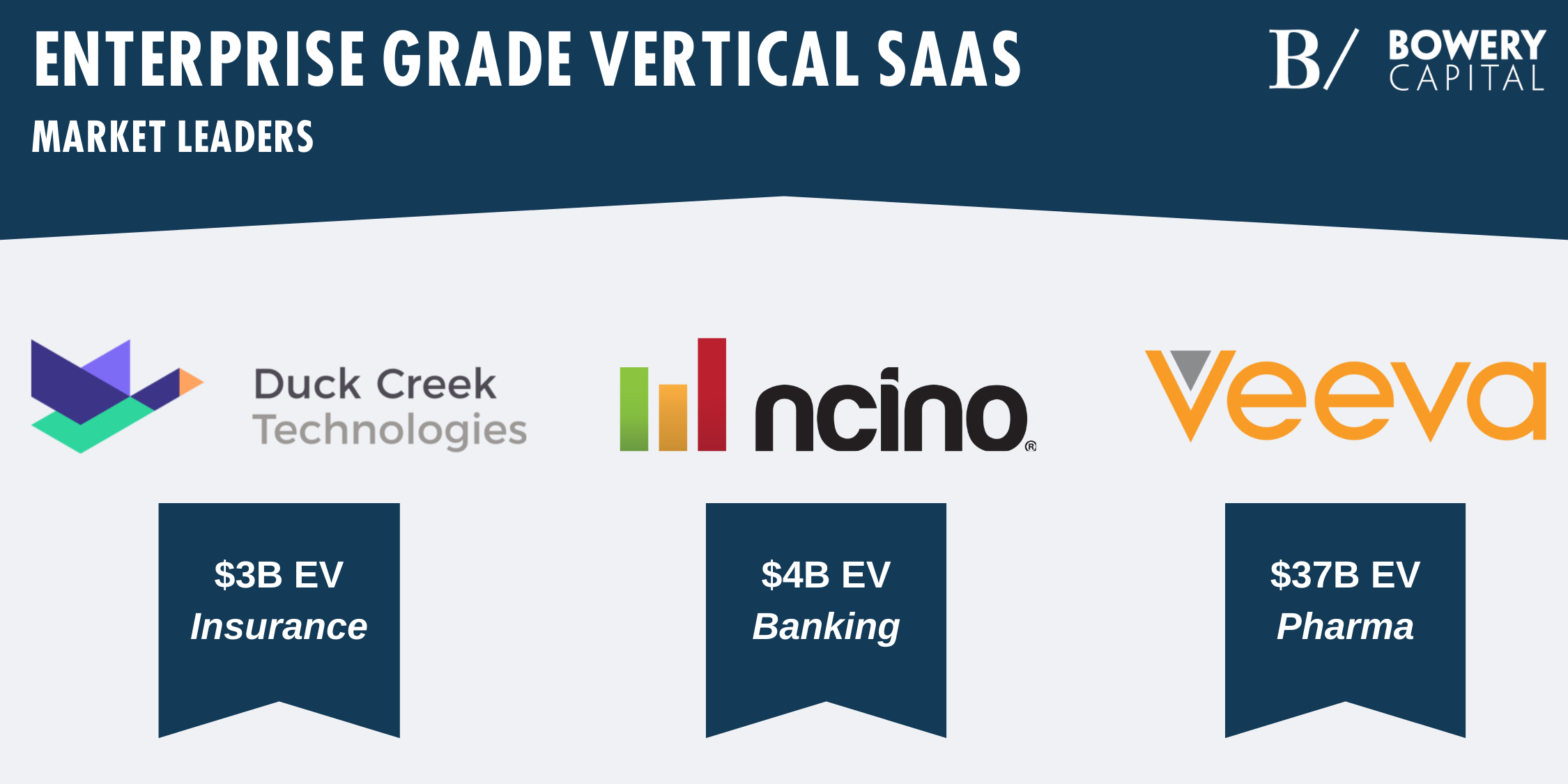

Over the last decade, the enterprise grade vertical software approach has minted a number of public scale success stories including nCino (selling into commercial banks), Duck Creek (selling into P&C insurance carriers), and Veeva (selling into large life sciences businesses). I estimate the ACVs of nCino at $275K, Veeva at $1.5MM and Duck Creek at $1.7MM based on some back of the envelope math on their 10-K’s comparing customer count and topline revenue. Another commonality across these three EGVS players is that they all sold into large organizations which already spent a significant amount on legacy software and were ripe for v2.0 of this enterprise grade approach.

At Bowery, one company we have backed which I would classify as enterprise grade vertical SaaS is a business called Klir (you can read a great interview with Klir's co-founder Dave Lynch on how they scaled to their first $1MM in ARR here). Klir sells software into regional water utilities providing them with a compliance OS for their highly-regulated operations and over time they have continued to expand the product to meet more and more of the needs of the wastewater and drinking treatment plants they sell into. We think increasing digitization, a shift towards verticalization across the software landscape, and the ability of AI to now automate specific tasks and roles with vertical software as a delivery mechanism are all positive trends for this business model.

Some areas we are particularly excited about and where we see the opportunity for the rise of new EGVS winners include:

Energy Production & Delivery - this entails operating systems for public energy utilities, large scale solar arrays, offshore wind farms, and so on; we think both traditional and renewable energy providers are primed for an end-to-end enterprise grade vSaaS approach.

Emergency Systems - fire and police departments have had computers in their vehicles for ~20 years but they still rely on a massively dated tech stack; one example of a recent investment in this space can be seen in a16z leading a $16MM Series A in 2023 into Prepared which is addressing the shortcomings of existing dispatch solutions.

Natural Resource Extraction - the large scale, project-based nature of these operations lend themselves to a ProCore-style system of record to handle the complex coordination needed between FTEs, contractors, suppliers, and regulatory bodies.

Insurance - at the carrier, reinsurer, and broker level there are still existing sub-categories that can benefit from EGVS. Duck Creek had success here in the P&C silo but we believe similar platforms can be built for adjacent insurance categories.

Healthcare - Epic Systems is one of the all-time great examples of EGVS and has locked up the higher-end of the healthcare market when it comes to hospital systems. We see analogous opportunities at the walk-in clinic level and in the PT/OT spaces where we increasingly see consolidation and large, multi-location practices with more complex practice management and coordination needs.

Wholesale / Distribution - verticalized ERPs or WMS’s are another flavor of EGVS that we think can be exciting. On the ERP side in particular, recent LLM advances have the potential to speed up some of the integration challenges that have plagued challenger ERPs by allowing them to ingest and process large swathes of unstructured company data, rather than building precise connectors between clunky legacy systems. We think this step change in product development time will expedite the creation of the coming wave of AI-enabled systems of record.

We are excited to back the next generation of enterprise grade vertical software builders. If you are building modern EGVS and want to chat further, you can reach me at patrick.mcgovern@bowerycap.com.

If you liked “Beyond The SMB: The Rise of Enterprise Grade Vertical SaaS” and want to read more content from the Bowery Capital Team, check out other relevant posts from the Bowery Capital Blog.