Congratulations! You reached the pivotal moment of receiving a job offer at a VC firm. Navigating the opaque recruiting process was no easy task, but you have one final hurdle to jump - negotiating your offer. Knowing how to do this is key to setting yourself up for success and optimizing your financial return. There are four main pillars and each is listed below in order of consideration.

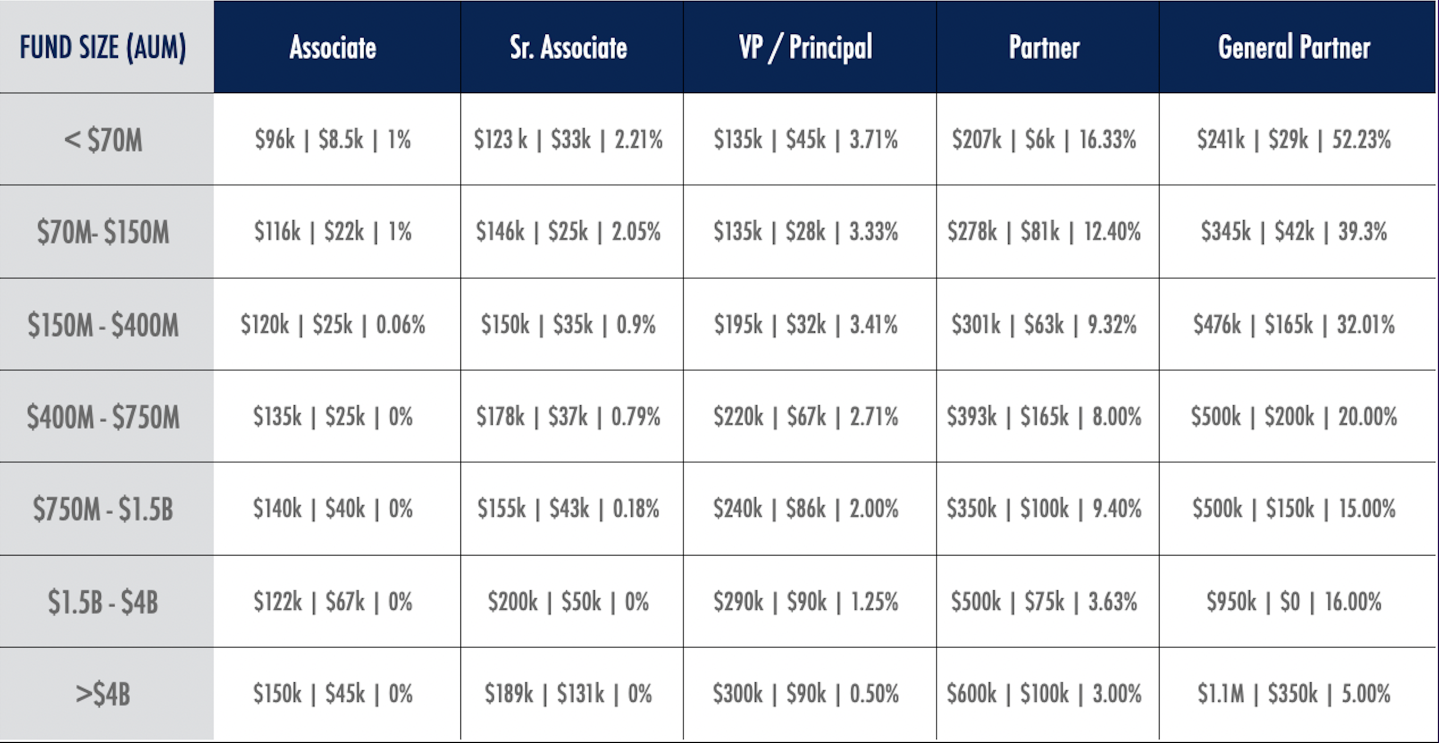

Base Pay: This refers to the baseline sum of money you can expect to receive and is expressed as a fixed number on an offer letter. As a rule of thumb, salaries come directly from the management fees available to the firm, usually 2.0 - 2.5% of Assets Under Management (AUM). Larger funds with higher available management fees are able to pay their employees more, and smaller funds have less latitude. Secondarily, salary ranges are generally pegged to industry compensation surveys. Cost of living, inflation, and living wage increases are the last factor that’s sprinkled into the mix. Before you get the offer, knowing a ballpark salary range from your peer group and industry surveys like John Gannon, EVCA, First Republic, or Richard Kerby’s from Equal Ventures is important to benchmark where the role you're interested in stack up. After receiving an offer, make sure the base pay is within that range, then try to negotiate for the high end of it or above it.

Bonus Pay: This is important in making up your total compensation picture. It refers to additional compensation above and beyond your normal pay expectations. Bonus pools are tied to a combination of management fees available, budgeting, and hiring plans. Some firms offer performance bonuses and others do not. If a firm does not offer a bonus, don’t bother negotiating for one. But if they do, treat the bonus as a compensation lever point if another area in your offer package such as base pay is lacking.

Carried Interest / Profit Sharing: This should be your next priority or in rare instances equally as important as base pay depending on your risk tolerance and liquidity needs. "Carry" as it’s more commonly referred to is the share of any profits from the fund's investments that is paid out to investors and employees of the firm. Carry has evolved considerably over the years. It used to be reserved exclusively for General Partners of a firm and mostly the Managing Members. However, as a changing of the guard happened and new firms emerged with more employee friendly values, many firms now grant some form of carried interest to all investment professionals. Not all firms offer carry, but those that do will typically base your carry allocation off a combination of industry survey averages and internal preferences. Similar to base pay, know your range and try to optimize for the upper limit of it. While you likely won't receive a substantial piece of carry as someone brand new to the job and venture ecosystem, asking a fund for more carry should get them excited. It sends a signal that you’re committed to the success of the fund and ties your work even closer to your compensation.

Other important questions to ask and understand related to your carry include:

- Vesting Schedule - How long you need to stay at your firm to receive your carry?

- Capital Percentage - Do you have to invest money to receive the carry? Some funds require this, others do not.

- Called vs. Uncalled Capital - How much of the capital has already been called and invested? Said differently how far into the fund investment period are they?

- "Real" Carry vs. "Phantom" Carry - Is this truly carried interest or is it something else? Real carry will usually be expressed in a GP agreement and Assignee Agreement. Phantom carry, also called synthetic carry, is generally expressed as a bonus pool or some alternative format. You usually are not "written into" the actual legal documents at the firm.

- Carry Valuation - Lastly, what will your future carry be worth based on reasonable exit assumptions. You can use a carry calculator to solve for these details. You can also review the current marks of the fund by asking for their quarterly capital account statement or quarterly report.

Below is a snapshot of average base pay and carried interest ranges across different titles and fund sizes.

Source: Equal Ventures; Locations of Firms include New York, San Francisco, Boston, Chicago, Austin, Los Angeles, Toronto, Minneapolis

Job Title. This should be your last negotiating priority. While your title should be commensurate with your experience and in-line with your peers, at the end of the day your official title has minimal impact. Definitely ask for the title you deserve and consider lateral and upward moves that you may make later. But of all the pieces above, this is not the hill to die on. Historical titling is - Analyst, Associate, Vice President, Principal, General Partner. Most founders are smart and they will look at your experience and background more than your title.

Now that you have the basics, it’s time to make your offer official. Next week, we will cover some more details on documents to ask for and other considerations on how to close that VC job.

If you liked “Congrats On The Offer, Now What?” and want to read more content from the Bowery Capital Team, check out other relevant posts from the Bowery Capital Blog.