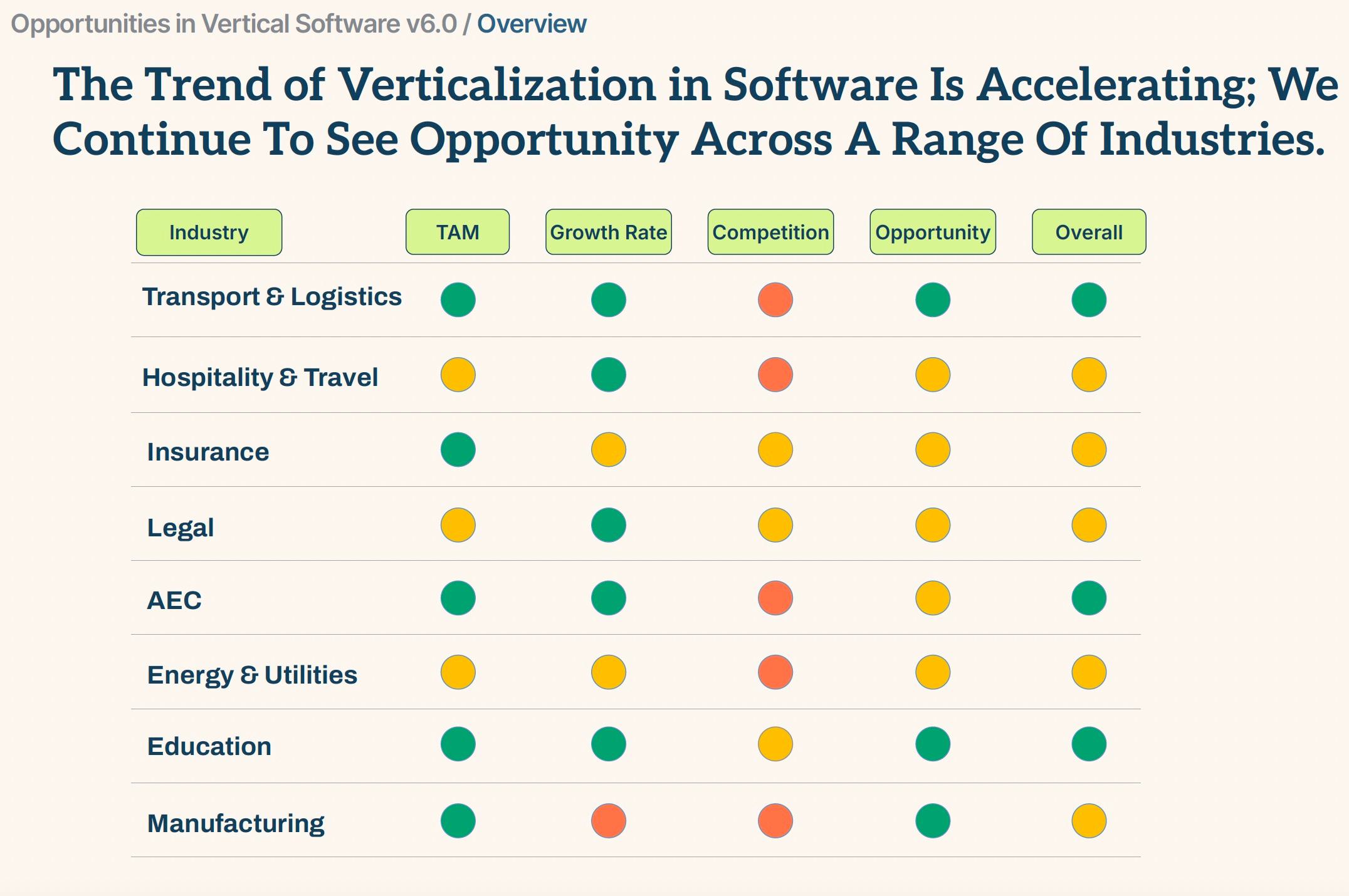

We are pleased to present the 6th edition of our Opportunities in Vertical Software report. The first edition of this report was published in 2014 and every two years we like to do a refresh to track how the vertical software landscape is changing. Vertical software has become one of the hotter investment categories since our last edition in 2022 with AI driving a surge of VC interest in the business model. As longtime vertical software investors, we like to use this report to share our views on various industries and to survey category-specific software spend, funding activity in different verticals, leading VC firms in each vertical, and much more.

The biggest change since v5.0 of this report (published in 2022) has been the advent of the AI era and the impact this has had on which verticals are more or less attractive from a software investment perspective. Categories like LegalTech which were once viewed by many as uninvestable are now attracting hundreds of millions in investor dollars and AI is creating a second act for vertical software. Today's vertical software platforms don't simply organize a business's processes, they can execute common workflows and act like a skilled colleague, rather than a passive database. Across the board, we continue to see an increase in software spend across verticals as industries continue to digitize and move from legacy to next-gen systems.

We are excited to see what the next two years hold for vertical software and in the coming weeks we will be sharing some additional thoughts on AI agents and how this current phase of the AI revolution will impact industry-focused applications. And if you want to hear some firsthand accounts from the vertical SaaS founders shaping today's software landscape, check out our Vertical Visionaries interview series. We welcome your feedback and commentary on our latest edition of Bowery Capital's Opportunities in Vertical Software report.

If you liked “Opportunities in Vertical Software v6.0” and want to read more content from the Bowery Capital Team, check out other relevant posts from the Bowery Capital Blog.